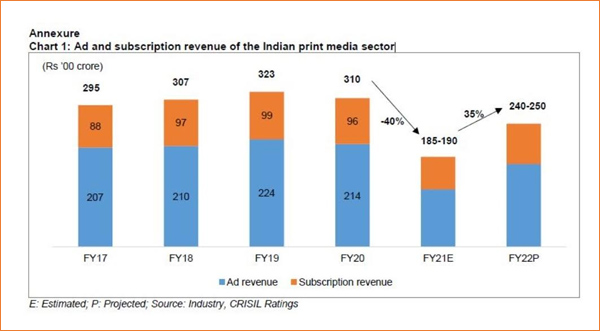

New Delhi: Despite 35 per cent on-year growth this fiscal on a low base, the country's print media sector will reach only three-fourths of its fiscal 2020 revenue, according to a new CRISIL report.

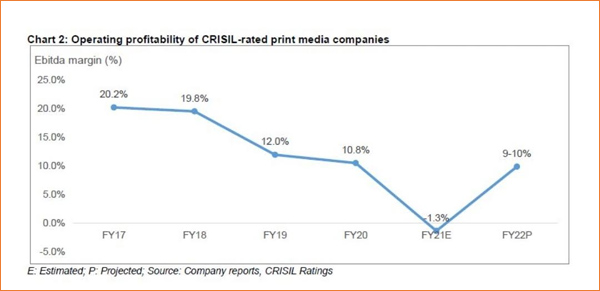

While the cost of newsprint continues to remain high, there is a good probability that profitability will revive to 9-10 per cent driven by sharp cost rationalisation measures and digitalisation of content, shows the report. The analysis assumes the impact of the second wave to continue to subside, as is seen currently.

According to CRISIL, the credit profiles of large print media companies will be resilient, cushioned by healthy liquidity and strong balance sheets, while for the remaining ones, liquidity management will be crucial, shows an analysis of CRISIL-rated companies that account for roughly 40 per cent of the sector’s revenue.

The sector’s revenue of Rs 31,000 crore in fiscal 2020, split 70:30 between advertisement (ad) and subscription revenue, had declined 40 per cent last fiscal amid the first wave. However, it is expected to reach to Rs 24,000-25,000 crore this fiscal, notwithstanding the second wave.

"The second wave has impacted ad revenues in the last quarter, as it correlates strongly with economic activity,” CRISIL Ratings, director Nitesh Jain said, “We expect ad revenues to recover from the current quarter as economic activity revives. But it would still reach only 75 per cent of the pre-pandemic level this fiscal, as seen during January-March 2021, before the second wave took hold.

As for subscription revenue, the sector is witnessing a structural change with a shift in consumer preference towards digital news, from physical newspapers. This is more prominent for English newspapers, which have a higher share in metros and Tier-1 cities, where digital adoption is also higher. These companies are, therefore, focusing on monetisation of content by putting premium news behind paywalls and pushing digital subscription along with print subscription. Non-English newspapers, on the other hand, had relatively resilient subscription revenue even in the first wave because of their strong roots in the hinterland.

“We believe, unlike western countries, print media will remain popular in India. Besides low cover price and the convenience of home delivery, it benefits from the ability to provide original and credible content, and people’s habit of reading physical newspapers,” stated the report, according to which, the overall sector’s subscription revenue loss this fiscal should be restricted to 12-15 per cent of the pre-pandemic level.

That said, printing physical copies of a newspaper requires newsprint – a key raw material that accounts for 30-35 per cent of the total cost for print media companies. Over the past six months, newsprint prices have risen 20-30 per cent

The run-up in cost notwithstanding, the operating margin is expected to reach 9-10 per cent this fiscal, or 100-200 basis points lower than the pre-pandemic low of fiscal 2020. This is because of sharp cost rationalisation measures undertaken by the companies, such as reduction in pagination, employee cost and other expenses.

Last fiscal, retailers strengthened their balance sheets through equity infusions of Rs 2,000 crore, which reduced overall debt for CRISIL-rated apparel retailers by 30 per cent.

CRISIL Ratings associate director, Rakshit Kachhal said, "Credit profiles of large print media companies will continue to be supported by ample liquidity and sustained strong balance sheets, with most being net-debt free. However, for the smaller ones, whose interest cover has declined to 1.6 times as on 31 March from 2.1 times a year ago, ability to manage liquidity amid the second wave and rising newsprint prices will still be crucial."