MUMBAI: Newspapers and online news media have been flashing headlines how this company or that brand has invested huge outlays to get associated with the Dream11 Indian Premier League (IPL) as a sponsor. These numbers could cue that the IPL is out of bounds for in brand managers in mid-sized and smaller companies or firms with limited budgets and lower amounts to spend on a high impact event like the IPL and possibly kept them from considering it as a property to be associated with.

But, wait, the IPL is not a big spender’s game alone. As we analyse some campaigns and advertisers from previous editions we see that brands have chosen smaller outlay routes in line with their budgets, campaign timings and business agendas. For instance, brands can associate with the IPL for less than 10 matches – rather than all the 56 matches. Then, there is the option of tying up for the live programming before and after each clash, featuring sports specialists and cricketing experts who dissect the upcoming game as well as the result of the just concluded one.

Experts opine that many a brand has opted for one of the two and hit their sales out of the park just like Pollard wallops many a bowler mercilessly for those deep sixes.

Take for example, Grofers.

In 2019, online grocery ecommerce platform Grofers went in for a burst of sharp advertising for a limited time period. It aired its commercials for as little as a week during the IPL matches between 31 March 2019 and 7 April 2019. The reason: research had pointed out that family habits had evolved and they were shopping for the entire month in bulk in the first seven days. So, it was looking at opportunities to make Grofers the first port of call for this activity. It partnered with banks and credit card companies and announced its Houseful Sale offering discounts on purchases with specific plastic brands.

The net outcome: searches on the market place surged 2.2x times at peak on 5 April and averaged a 50 per cent hike for the entire duration of the TVC.

Grofers vice-president marketing Prashant Verma was delighted with the results. Said he: “Advertising during the IPL elevated the impact of our campaign and we saw great results on both brand and business metrics – in terms of organic reach, brand lift on consideration, growth in order volumes, and new user acquisition.”

Cricket legend MS Dhoni has been associated with consumer electricals company Orient Electric as its brand ambassador. The CK Birla group outfit, which is known for its exotic fans, has also been a partner of the Chennai Super Kings team for several seasons now.

It opted for the IPL’s team package and through it found a way to target audiences and followers of CSK matches and was able to build the association of Orient MS Dhnoi and CSK.

It strewed its commercials featuring Dhoni in all programming related to the IPL and team CSK. And it worked wonders. According to BARC data, the brand’s reach not only increased in the urban markets in the 22-50 age group, - which was the brand custodian’s objective - but its business grew at a scorching 30 per cent in revenues – double its competitor’s ramp ups.

Brands also have the option to choose feature properties, like the Orange Cap, the super sixes, or the fours, or the fall of wickets, or super catches. Just like, TooYumm - the healthy snacking brand from the RPG-Sanjiv Goenka group stable - did by becoming the fall of wickets partner and resorted to moment marketing successfully. You can find out more about what it did and the results it got by reading How Too Yum hit a Six with the IPL.

For advertisers it’s a win-win all the way. Even as the outlays are smaller as they are for a limited quota of matches, they manage to get amassive bang in terms of impact intheir limited spots.

For advertisers it’s a win-win all the way. Even as the outlays are smaller as they are for a limited quota of matches, they manage to get amassive bang in terms of impact intheir limited spots.

BARC data highlights this.

The reach for the first 10 matches varied between 345 million and 241 million in 2019’s IPL (U+R 2+). As compared to this, a top rated GEC show during the festive season generated a reach of 185 million on the higher side.

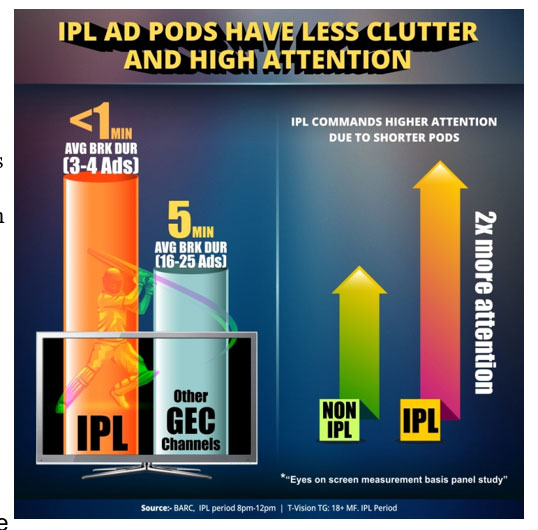

The ad breaks during the IPL cricket matches are usually less than a minute long and do not show more than three to four ads at once, while in a general entertainment channel, the ad breaks are of five minutes duration with 14-25 ads in them, so the clutter is much higher. Also, due to the longer ad break duration attention (eyes on screen during ad break) in IPL is high - up to two times than in GEC breaks.

The ad breaks during the IPL cricket matches are usually less than a minute long and do not show more than three to four ads at once, while in a general entertainment channel, the ad breaks are of five minutes duration with 14-25 ads in them, so the clutter is much higher. Also, due to the longer ad break duration attention (eyes on screen during ad break) in IPL is high - up to two times than in GEC breaks.

So with an imaginative and attention-grabbing creative and campaign, advertisers can but be sure that they will get a return for their hard earned buck.

According to Group M entertainment and sports head Vinit Karnik the festival called IPL offers innovative ideas and smaller packages that the broadcaster’s sales team churns up. “Brands are willing to explore these opportunities and will find reasons to associate with them. In these Covid times, the Indian Premier League has become that little cheer which we will watch in our living rooms,” he says.

Clearly, that’s a thought to ponder upon.