MUMBAI: The Asia Pacific online video market will double in size over the next five years, according to analysis released today by Media Partners Asia (MPA), as the explosion of screens and smart devices, driven by mobile broadband connectivity, drives digital growth and scalability across the region.

In Asia Pacific, online video advertising and subscription revenue will expand from US$26 billion in 2019 to US$52 billion in 2024, a 15% CAGR, MPA forecasts. As a result, online video will contribute 33% of combined TV and online video revenue in Asia Pacific by 2024, up from 18% in 2019. Excluding China, online video will maintain a 15% CAGR in the region to increase revenues from US$10 billion in 2019 to US$21 billion by 2024. This will extend online video’s share of the video market in APAC ex-China from 15% to 25% over the same time-frame.

MPA’s analysis covers 16 Asia Pacific markets with a focus on consumer and advertiser spend, content costs and market share across key clusters. The full findings will be presented at the APOS Summit (April 23-25), a leading event for industry leaders in media, telecoms, sports and entertainment.

Commenting on the MPA analysis, executive director Vivek Couto said:

“China remains at the forefront in online video scalability and innovation, although monetization models are starting to scale in other major markets. The growth of broadband connectivity and digital video platforms is driving new economic value for content creators, aggregators and sports-rights owners at a global and local level, helping seed digital ecosystems. That said, piracy and unpredictable regulation present key impediments to progress. Meanwhile, a still lucrative legacy TV industry continues on a low-growth trajectory in many markets, although under increasing pressure. In certain markets, the value erosion across legacy TV is unlikely to be replaced over the medium term but digital video monetization will grow and margins will recover as costs recalibrate.”

Growth Prospects For Key Markets and Regions

MPA forecasts show Asia Pacific video industry revenues, comprising TV and online platforms, scaling to

US$154 billion in 2024 with a 4.5% CAGR from 2019. Ex-China APAC revenues will grow at a slower

3.7% CAGR to total more than US$84 billion in 2024. In aggregate, the TV industry in APAC will manage a ~1% CAGR from 2019-24 in contrast to a dynamic online video sector growing 15% each year.

The balance between advertising and subscription revenue is also changing, due to shifting dynamics in China. Advertising’s share of APAC video revenues will decline to 53% by 2024 from 55% in 2019 as subscription scales further in China. Subscription, in turn, will contribute 47% to the pie in 2024, up from

45% in 2019. Ex-China, advertising’s contribution will remain constant over 2019-24, accounting for 56% of video revenues with subscription providing 44%.

Key markets and regions include:

• China. Video revenues in China will expand by a 5.4% CAGR from 2019 to create a US$70 billion industry by 2024. The growth engine is online video revenue,

climbing 14% each year and increasingly anchored to subscription payments. Online platforms will boost their share of video revenues from 29% in 2019 to 44% in 2024 as challenges mount up for TV incumbents.

• Japan. Online video is growing 10% Y/Y, offsetting declines in a large TV market. Overall, Japan’s video industry should notch up a 1.2% CAGR from 2019 for US$28 billion in advertising and subscription revenue by 2024. Over that period, online’s share of total video revenues will expand from 14% in 2019 to 22% in 2024, mainly driven by advertising.

• India. The video market is set for an 8% CAGR from 2019, the fastest growth in the region, propelling advertising and subscription revenues to almost US$20 billion by 2024. TV will still enjoy a robust 6% CAGR over that time although online video will rocket forward with an explosive 22% CAGR. Online video will account for

16% of video revenue in India by 2024, up from 9% in 2019.

• Southeast Asia. Video industry revenues should expand at a 4% CAGR from 2019 across Southeast Asia to reach US$11 billion by 2024, with Indonesia, Thailand and Vietnam contributing almost 65%. Indonesia, Southeast Asia’s largest video market, should grow 5% annually to 2024, bolstered by a 24% CAGR in online video.

• Australia & New Zealand. The growth of online video subscription and advertising is driving more opportunity in two mature TV markets, supporting a 5% industry CAGR from 2019 to create an almost US$11 billion video market by 2024. Online’s share will reach 53% by 2024, up from 33% in 2019.

• Korea. Online video revenues should scale up at a 17% CAGR from 2019, rising rapidly off a low base amidst a sharp slowdown in TV. Korea’s video industry is set for 3% annual growth from 2019 to surpass US$10 billion in revenue across TV and online platforms by 2024.

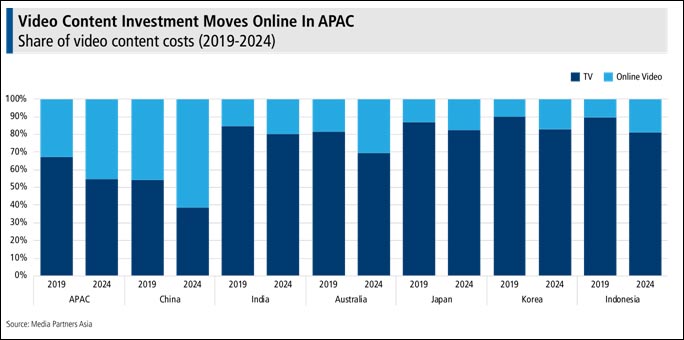

Content Investment Shifts Online

Industry investment in video content is expected to grow at a 3% CAGR in Asia Pacific to reach US$73 billion by 2024, up from US$64 billion in 2019. The moderate pace of growth reflects contracting spend in TV as budgets rationalize, especially on third party content and sports rights. Online video content spend, meanwhile, will climb at a 10% CAGR over 2019-24 to reach US$33 billion by 2024, driven by growth across the region as well as cost inflation for Asian entertainment, sports rights and Hollywood content. China will extend its clear lead with US$27 billion spent on online video content in 2024, followed by Japan at US$1.7 billion and India at US$1.4 billion.