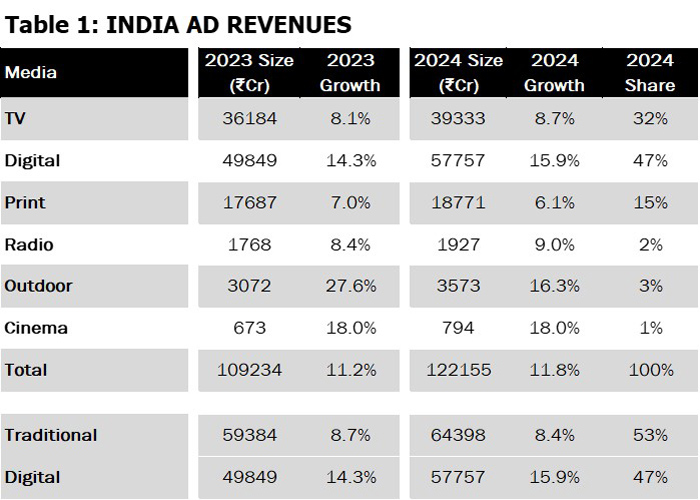

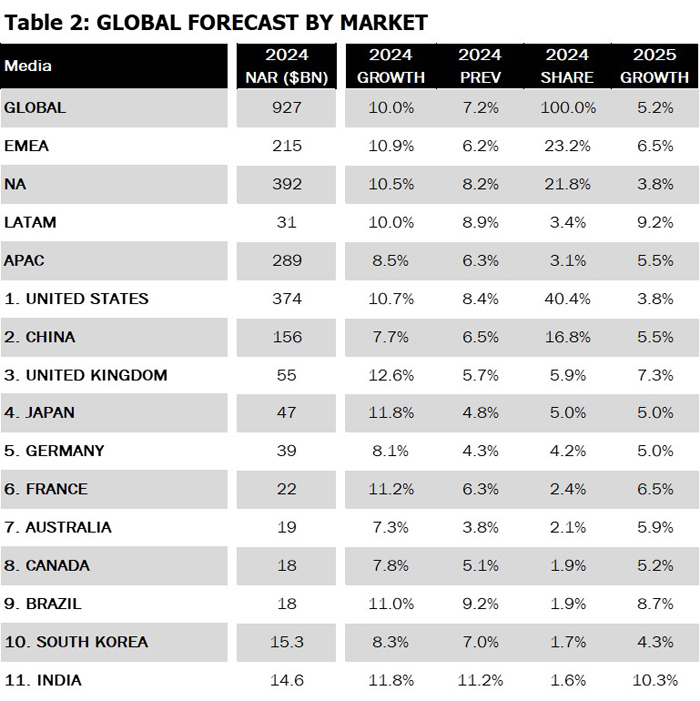

Mumbai: Indian advertising industry continues its growth trajectory from ₹1.1 trillion ($13.1 billion) in 2023 to Rs 1.2 Trillion (US$14.6 billion) in 2024, 50 per cent higher than pre-pandemic period. However, print, radio and cinema are lagging 2019 levels. The advertising revenue is forecast to grow +11.8 per cent in 2024 (+11.2 per cent 2023) according to Magna Global Advertising forecasts.

Digital media is poised for +15.9 per cent growth, the surge is propelled by the Government of India’s thrust on digital infrastructure, making the internet accessible and affordable. Digital share from its current 47 per cent is expected to reach 50 per cent of the total revenues by 2026. Social overtakes search to become the second largest media after television.

Traditional media is also experiencing growth year-over-year. Linear formats to grow at +8.4 per cent (8.7 per cent, 2023) in 2024.Maintaining its fastest growing economy status, GDP is projected to remain strong at +6.8 per cent in 2024 (+7.8 per cent 2023) and +6.5 per cent in 2025.Magna estimates +10 per cent growth in 2025 and continue to grow at a CAGR of 10 per cent to reach Rs 1.7 trillion ($21.1 billion) by 2028. India is projected to move into the top 10 markets in 2025.

MAGNA India SVP, director - Intelligence Practice Venkatesh S said: "The Indian advertising market is set to expand by 11.8% in 2024, reaching ₹1.2 trillion, driven by a robust 15.9% growth in digital media. Traditional media formats are also growing, enduring the relevance of Print, OOH and Radio in addition to Television. The government’s emphasis on digital public infrastructure is propelling digital ad spend to nearly half of total revenues by 2026. Our forecast highlights social media's significant rise, overtaking search as the second largest media format after television."

Growth in India is projected to remain strong at 6.8 per cent in 2024 and 6.5 percent in 2025, with the robustness reflecting, continuing strength in domestic demand and a rising working-age population according to IMF. With the per capita income increasing multifold, the consumer spending outlook remains positive. India has been evolving as one of the world’s most dynamic consumption environments and is expected to maintain steady economic growth. The fastest growing economy is projected to surpass China’s growth rate by over two per cent points. India, by 2028 is expected to become the third largest economy leaving behind Germany and Japan.

Inflation is projected to decline from +5.4 per cent in 2023 to +4.2 per cent in 2024 and long-term inflation estimates remain anchored. The monetary policy stance of the central bank is expected to support growth.

In 2024, total advertising revenue from Rs 1.1 trillion ($13.1 billion) will touch Rs 1.2 trillion ($14.6 billion). Digital formats or new media contribute over 60 per cent to the incremental revenue. Digital is estimated to grow +15.9 per cent and linear growth will be at +8.4 per cent. In a normal year, H1 contribution is generally less than H2, however general elections scheduled from March to May followed by ICC T20 Cricket World Cup in June-July will boost H1 growth (+11.8 per cent) equal to the second half of the year (+11.9 per cent). Both general elections and live sports will lead to a significant growth in adex across both Digital and Linear media.

In 2023, listed companies’ average income and profits have grown in double digits. This is encouraging as private investment in capacity building and marketing activities will increase. Auto sector demonstrated significant growth across all segments in 2023, this is expected to boost marketing and advertising budgets in 2024. CPG continues to rise as more people start to move up the economic ladder and the benefits of economic progress become accessible to the public. The urban segment is the largest contributor, however, in the last few years, the growth has come at a faster pace in rural India. With normal monsoons expected, rural demand will pick up and this bodes well for the sector. Retail sector is experiencing exponential growth across pop strata. Sizeable middle class, changing demographic profile, increasing disposable income, and urbanization are some of the factors driving organized retail. E-commerce has transformed the way business is done and has enabled newer segments like D2C. Rapid expansion into Tier-2 and Tier-3 cities will aide sectoral growth.

CPG, Auto, Retail, Government & Political advertising, and Finance are expected to be the most dominant sectors contributing to India’s adex growth in 2024, followed by Pharma, Education, Real Estate, Media & Entertainment and Building Materials making up the top ten sectors.

Consumption trends continue to favour digital media. The liberal and reformist policies of the Government have been instrumental in developing digital public goods. All digital formats are growing at a healthy pace, specifically social, video & audio streaming and online gaming. With the democratisation of content consumption, Ad-supported video on demand platforms have transformed viewership by providing easy and affordable access to live sporting events. As of 2023, wireless base stood at 1.15 billion subscribers and 95 per cent of the data consumed have come from 4G connections. Rise in mobile penetration and decline in data costs is expected to add to the internet base. In 2024, digital ad spends will grow +15.9 per cent to top ₹580 billion (US$6.9 billion). Social & Search with 34 per cent and 33 per cent shares drive the digital pie followed by Display & Video at 19 per cent and 14 per cent. In terms of growth, Social (+21.9 per cent) and Video (+19.1 per cent) are the fastest growing formats.

Television reaches 778 million viewers (759 million 2022) and overall time spent has increased to 230 mins (218 mins 2022). Close to a third of homes do not have television and linear TV has potential to grow. Probable launch of Direct-to-mobile will increase the reach of Television, trials for this home-grown technology would soon be planned across cities. Overall Television ad revenues in 2024 will grow +8.7 per cent to reach an estimated Rs 393 billion ($4.7 billion). Elections will drive advertising growth for TV, specifically for news and T20 World Cup will further boost revenues.

Print media has reinforced itself as the most trustworthy source of information. The circulation in 2022-23 has gone from 391mn to 402mn copies and the largest local media is still relevant providing the geographical spread and audience size. Advertisers’ belief in this consumption story led to a handsome growth of +7.0 per cent last year. In 2024, ad sales revenue will grow +6.1% to Rs 188 billion ($2.2 billion) but it is still 11 per cent below pre-covid levels. Digital print revenue is estimated to be Rs 13 billion ($159 million). Drop in social media referral traffic as Meta dissociated itself with news is hurting publishers. Print advertising growth will come on the back of national elections and local elections in 8 states.

Radio is still ailing from the slowdown caused during covid, recovering only 86 per cent of the 2019 levels. While there is enormous increase in volumes, ad rates have remained soft. The long-standing challenge of audience measurement capabilities is hurting the medium. Increase in Government ad rates will help growth considering this is an election year. Government recommendations on News broadcast, reduction in license fee and mandatory FM tuner on mobiles will bring windfall to the industry. The revenue for 2024 is estimated to be Rs 19 billion ($231 million) reflecting a growth of +9.0 per cent over previous year.

OOH media is on a growth trajectory and is expected to cross 2019 levels this year. All 3 forms, Traditional, transit and DOOH are showing incremental revenues. Government push on infrastructure and urbanization will boost OOH inventory especially premium formats. In 2024 OOH revenue will increase +16 per cent to reach ₹34 billion (US$402 million). DOOH share to total OOH is at 6 per cent, growing at a CAGR of +33 per cent, by 2028 share of DOOH will touch 11 per cent. Roadstar, a unified audience measurement tool for the OOH industry developed by the national body for Outdoor Media, is likely to see light, this should help demonstrate effectiveness of the medium and facilitate growth. In-cinema advertising was the biggest casualty of covid which has recovered to the extent of 72 per cent. Successive come back from all languages with box office hits in 2023 and good inflow of content in 2024 will drive both demand from advertisers as well as surge in audience footfalls. In 2024, the growth is estimated to be +19 per cent to reach Rs 8 billion ($95 million).

IPG Mediabrands India chief investment officer Hema Malik commented: “India's advertising industry is gearing up for an impressive 2024, with significant growth driven by pivotal events like the general elections and ICC T20 World Cup. We expect substantial ad spend increases across sectors such as auto, retail, and CPG. The anticipated 11.8% growth in ad revenues highlights the market's resilience and potential. With rural demand expected to rise due to favorable monsoons and digital ad spend projected to reach ₹580 billion, the convergence of traditional and digital media presents unique opportunities for advertisers."