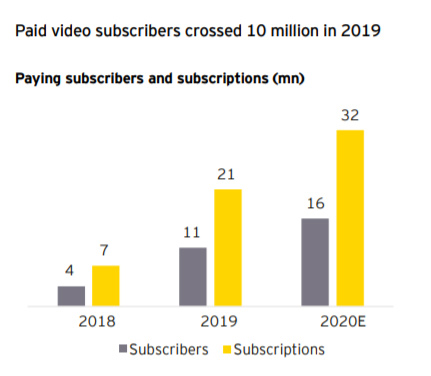

MUMBAI: The Indian media and entertainment industry has moved beyond the era where consumers are not willing to pay for premium content online. Although the number of paying consumers remains low compared to overall users, the growth is visible, according to FICCI-EY 2020 report. In 2019, over 10 million subscribers paid for 21 million OTT video subscriptions for the first time. Overall digital subscription also grew over 100 per cent to reach Rs 29.2 billion.

Video subscription revenues grew 111 per cent in 2019 as premium content – originals and sports – went behind the paywall and amounts paid by telcos on behalf of their customers to content owners increased significantly. Audio subscription grew comparatively slower at 18 per cent in 2019 as platforms are still in the customer acquisition phase and several free products are available. However, the percentage of paying subscribers to total OTT consumers remained less than five per cent and one per cent for video and audio, respectively.

One of the key drivers for the growth of video subscription is a cricket-heavy 2019, with Hotstar creating an annual sports pack at Re 1 per day. The report also mentioned that increased television subscription prices due to the implementation of the NTO in February 2019 led to certain viewers, mainly English content viewers, preferring to subscribe to relatively more affordable OTT services. Moreover, over 1600 hours of original content were created for OTT platforms across films and episodic content, which led to increased demand.

There were several moderations in subscription packages also. Free/trial access to leading OTT platforms was provided by telcos and MSOs, bundled with data or television subscriptions, of between one and six months. Major players including Netflix introduced several sachet packs.

The entry of Spotify, Apple Music, YouTube Music, etc. boosted the growth of audio streaming subscription during 2019 along with increasing smartphone penetration in India. The number of music streamers has increased to 180-200 million from 150 million in 2018. However, paid subscribers remained below per cent, due to the prevalence of free options across all the large streaming platforms as well as music availability on YouTube.

The report predicts that overall digital subscriptions will grow at a CAGR of 30 per cent until 2022.